When it comes to Financial Planning, the First and Foremost thing that comes in mind is how to save tax! By lowering our taxable income through income tax deductions, we all attempt to save taxes.

Unfortunately, we often pay more tax than we should because of an inadequate understanding of the available income tax basic deductions.

The income tax department offers several Chapter VI A deductions from taxable income to promote investments and savings among taxpayers. Under income tax Chapter VIA, sections 80C to 80U allow for the claim of certain tax-deductible expenses.

Despite the most well-known deduction, 80C, numerous tax deductions help individuals lower their taxable income.

Let’s understand these sections in more detail :

Tax Deductions under Section 80C

An individual or Hindu undivided family (HUF) can deduct taxes from their taxable income up to Rs. 1,50,000 under Section 80C of the Income Tax Act of India.

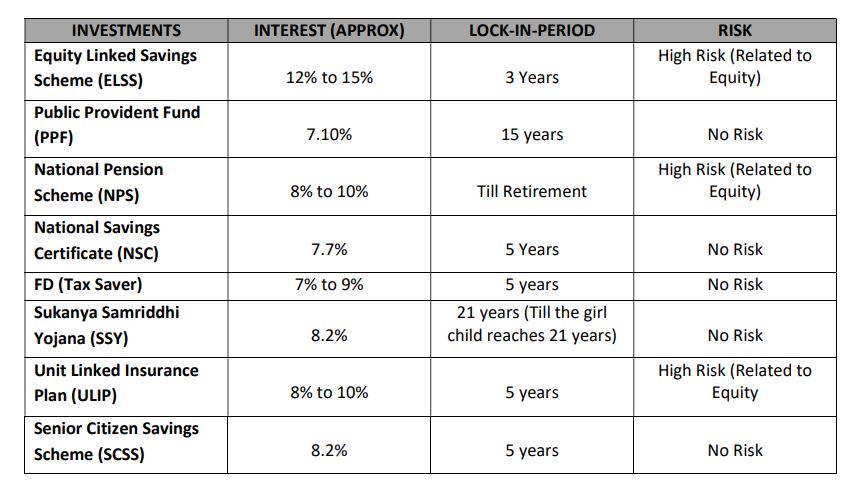

The investments that are currently on the list are those that qualify for Section 80C deductions:

Note: Kindly be informed that the interest rates may vary based on market conditions and other relevant factors.

Deduction under Section 80CCC

Income tax deductions under Section 80CCC of the Income Tax Act are available to taxpayers who purchase specific annuity plans or pension funds provided by public insurance companies.

Here are a few guidelines to follow when obtaining benefits under this section:

- Hindu Undivided family is not eligible to claim a deduction under this Section, resident and non-resident Indians may claim these deductions. Only Individuals can claim this deduction.

- The Maximum Deduction is Rs 1,50,000.

- The policy’s pension must be paid in accordance with the guidelines outlined in Section 10(23AAB)

- Annuity pension schemes do not allow deductions for accrued bonuses or interest.

- Every penny received from pension plans and annuity programs is subject to taxation.

- Even if you give up the plans for any reason, the Surrender Value will be taxable.

Also Read :Exploring 18 Tax-Free Incomes in India for Optimal Financial Planning

Deduction under Section 80CCD

This section indicates that individuals may deduct their contributions to pension Scheme of Central Govt., National Pension Scheme (NPS) or The Atal Pension Yojana (APY).

There are three sections in Section 80CCD, which are as follows:

Section 80CCD (1)

Under section 80CCD (1), Employee contributions to NPS accounts are tax deductible up to Rs 1.5 lakh. This tax advantage does, however, fall under the Rs 1,50,000 general section 80CCE ceiling limits.

| Salaried Employees | Other Individuals |

| Employee Contribution or 10% of Salary (Basic + DA), whichever is Less | Assessee Contribution or 20% of Gross Total Income(GTI), Whichever is less |

Section 80CCD(1B)

Amendments to this Section were made during the 2015 Union Budget. It provides an extra Rs 50,000 deduction. Only those who made NPS contributions—whether they are self-employed or salaried—are eligible for this deduction. However, it is and additional deduction so, it doesnot fall under the Rs. 1,50,000 general section 80CCE ceiling limits.

you can invest up to Rs. 2 lakh in an NPS account and claim a deduction of the full amount, or Rs. 1.50 lakh under Sec. 80CCD(1) and Rs. 50,000 under Section 80CCD(1B),

Section 80CCD (2)

Sections 80CCD(1) and 80CCD(1B) allow you to deduct your contributions to NPS, while section 80CCD(2) allows your employer’s contribution to your NPS account to be tax deductible. The Deduction amount shall be Employer’s Contribution or 10% of Salary (Basic + DA), Whichever is less and 14% where Such contribution made by central government and state government.

Note: Under Section 80CCE, the maximum deduction limit is Rs. 1.5 Lakh, Considering 80C, 80CCC & 80CCD(1)

Section 80CCE = 80C + 80CCC + 80CCD(1) = Rs. 1,50,000

| Section | Maximum Deduction | Max Deduction (80CCE) |

| 80C | Rs. 1,50,000 | Rs 1,50,000 |

| 80CCC | Rs. 1,50,000 | |

| Employer’s Contribution u/s 80CCD(1) | 10% of Salary | |

| Additional Deduction u/s 80CCD(1B) | Rs. 50,000 | Not Applicable |

| Employer’s Contribution u/s 80CCD(2) | 14% or 10% of Salary | Not Applicable |

Also Read : 6 Effective Strategies for Saving Income Tax

Deduction under Section 80D

Section 80D of the Income Tax Act provides deductions for premiums paid towards health insurance policies. This section encourages individuals to safeguard their health by offering tax benefits. Resident individuals and Hindu Undivided Families (HUFs) are eligible for deductions under Section 80D.

Deduction of Rs. 25000 can be availed under Section 80D on insurance of Self, Spouse and dependent Children. An Additional deduction of Rs 25000 can also be claimed for parents, if their age is below 60, otherwise Deduction of Rs 50000 can be claimed if age of the parents exceeds 60.

In case, the Assessee itself is above 60 years of age, Both the Assessee and Parents can avail a maximum deduction of Rs 1 Lakh under this Section.

Also Read : Income Tax Returns in Brief

Upshot

Understanding the Sections will enable you to carefully plan your tax savings, assisting in the development of savings for unexpected future expenses. Your short- and long-term financial goals should always be taken into consideration when selecting investment plans or schemes.