Hey folks, it’s 2024 here, and still it will be a challenging task to Save money. Understanding the world of finance in 2024 requires a smart strategy to overcome the never-ending challenges of inflation. Learning how to protect your wealth becomes essential as long as living expenses keep rising.

We explore tactics specifically designed for the Indian market in this guide, providing you with a road map to not only beat inflation but also prosper in the face of economic uncertainty. In this blog post, learn how to beat inflation in 2024 to safeguard your financial future and maintain a lead over inflation in this unpredictable year.

Of course! A deep approach to financial planning and investments is required to beat inflation.

Understanding INFLATION

Inflation is the state in which the prices of goods and services rise on the one hand and the value of money falls on the other. It reduces the Purchasing power of the Economy.

For Example: Considering Fuel Costs :

- Before Inflation: Petrol is priced at ₹87 per liter.

- After Inflation: In an inflationary environment, the price might increase to ₹97 per liter, impacting transportation costs for individuals and businesses.

Types of Inflation

Demand Pull Inflation: When companies don’t raise production to keep up with the present demand for products and services, demand push inflation happens, or in simple terms, when Demand is greater than the Supply of Goods and Services.

Cost-Push Inflation: When there is an increase in the cost of Production, it leads to Cost Push Inflation. If production costs for a particular industry rise, like an increase in raw material prices, the cost-push effect may lead to higher prices for the final products. A car that used to cost ₹800,000 might see a price hike to ₹850,000 due to increased production costs.

Stagflation: High unemployment rates and slow economic growth are often associated with stagflation. In this type, there is a fall in output and employment levels. Despite a slow economy, prices of goods and services might still experience significant increases. For instance, if a gadget costs ₹10,000, it may rise to ₹11,000 even during economic stagnation.

Hyperinflation: Extremely high and uncontrollable inflation, often exceeding 50% per month. Money loses its value to the point where alternative mediums of Exchange are used. For instance, If a commodity costs ₹100 at the beginning of the month, in hyperinflation, it might skyrocket to ₹150 or more by month-end.

How to Beat Inflation in 2024

Before that, you must know what Beating Inflation means and why it matters!

Beating Inflation refers to the Strategies taken by Individuals, Businesses, and Policymakers to maintain the purchasing power of Money in a situation where the general price level of goods and services is rising.

Achieving more returns on investments than the rate of inflation within the economy is known as beating inflation.

Let’s understand it with an Example :

Suppose you have savings of ₹100,000, and the inflation rate is 5% annually.

Beating Inflation Strategy:

- Investing in Equities: You decide to invest a portion of your savings, say ₹50,000, in a diversified portfolio of stocks. Historically, stocks have shown the potential to outpace inflation over the long term.

- Fixed Deposit: The remaining ₹50,000 is placed in a fixed deposit offering an interest rate of 6%, providing a nominal return.

After One Year:

- Equity Portfolio: Due to favorable market conditions, your equity portfolio has grown by 10%, reaching ₹55,000. This reflects a return exceeding the 5% inflation rate.

- Fixed Deposit: The fixed deposit has earned ₹3,000 in interest, resulting in a total of ₹53,000.

Now if we Compare the:

- Total Portfolio Value: ₹108,000 (₹55,000 from equities + ₹53,000 from fixed deposit)

- Purchasing Power: Despite inflation, your purchasing power has increased by ₹8,000.

Here is a detailed breakdown of various strategies:

Invest in Equities

- Historically, stocks have provided returns that outpace inflation in the long run.

- Companies can increase prices for their products/services, leading to higher revenues and potentially higher stock prices.

- However, stocks come with volatility, and there are no guarantees. Long-term investing and diversification can help manage risks

- Have proper research before investing to beat inflation.

Also Read: Beginner Tips for investing in the Stock market

Invest in Mutual Funds

- Mutual funds are comparatively safer than stock investments because of their diversification. The typical return range for mutual funds is 10% to 15%.

- You can invest in debt-oriented funds, equity-oriented funds, or equity-linked savings schemes (ELSS) based on your tolerance for risk.

- Professionals manage the money in mutual funds. As a result, you shouldn’t be too concerned about market volatility.

- Before making any kind of mutual fund scheme investment, you need to think about the following ratios:

Expense Ratio: It is the fee fund houses demand to oversee that particular plan. Like Management Fees, Administrative Costs, Distribution Fees Etc.

Beta: A mutual fund’s beta value is frequently used to express the fund’s volatility, or its profits or losses, in comparison to the standard index for that fund. A scheme is more volatile than its benchmark if its beta value is greater than 1. The scheme is less volatile than the benchmark if the beta is smaller than 1.

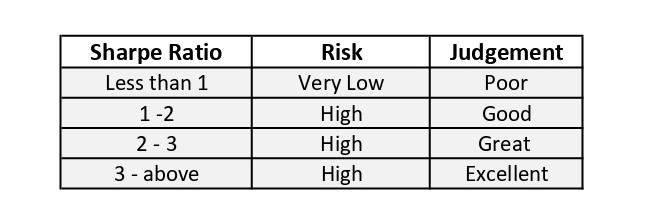

Sharpe ratio: It keeps track of how well the plan performs concerning the risk assumed.

Also Read: Start Smart: The ABCs of Mutual Funds – A Beginners Guide

Invest in Real Estate & Gold

Real assets such as real estate and commodities like Gold often appreciate inflation. Real estate values tend to rise, and commodities act as a hedge against currency devaluation. In India, gold has always been a popular financial option with significant sentimental and cultural importance. It is often considered a safer investment when compared to the stock market’s volatile and cyclical swings, However, Real estate investing requires a large initial investment that can reach several Lakhs or crores.

According to a World Gold Council study, the demand for gold increases by 2.6% for every 1% increase in inflation, and almost anything that experiences a spike in demand experiences price increases.

Also Read: Tax-Free Gold: Understanding the Secrets for Storing Gold at Home

Debt Investments

The country’s interest rates, which often correlate directly with the rate of inflation, usually have a connection to the debt market. Therefore, whether you’re a low-risk or risk-averse investor, increasing the proportion of debt-based assets in your diversified portfolio may help you beat inflation.

Interest rates increase when inflation increases. Bond prices move against interest rates. Bond prices will hence decrease in this scenario.

When investing in debt, you might think about to :

Invest in Inflation-Indexed Bonds: The Indian government issues inflation-indexed bonds (IIPs), which are designed to provide investors with returns to beat inflation. An ‘index ratio’ is used by the RBI, which oversees the bond on behalf of the government, to protect the principal amount against inflation. On the adjusted principal, investors earn interest income. Consider bonds with maturities matching your investment horizon.

Invest in Debt-Mutual Funds: Mutual funds that invest in individual bonds are called debt mutual funds. Investors who have a lesser capacity for risk are strongly advised to consider debt funds. The majority of debt mutual fund categories have seen returns of 7 to 10 percent overall in the last five to ten years.

Reevaluate Cash Holdings

Holding too much cash may result in a loss of purchasing power over time due to inflation. Maintain a balance between liquidity needs and investments that can generate returns exceeding inflation. Emergency funds and short-term needs justify holding cash, but excess cash may limit potential returns.

Invest in Yourself (Education and Monitoring)

One of the finest strategies to keep your purchasing power over time is to invest in your talent. Stay informed about economic indicators, central bank policies, and global events that can impact inflation. Regularly review your investment strategy and adjust it based on changes in your financial goals and market conditions. Continuous learning and monitoring ensure that your investment decisions align with the evolving economic landscape.

Also Read: A Beginner’s Guide to Master both Technical and Fundamental Analysis

Diversification Across Asset Classes

Spread your investments across various asset classes like stocks, bonds, real estate, and commodities. Different assets may respond differently to economic conditions, providing a hedge against inflation. Diversification doesn’t guarantee profits or protect against losses, and the right mix depends on your risk tolerance and investment goals.

Upshot

It’s still difficult to predict whether the current inflation increase will continue or begin to decline.

Overcoming inflation requires an in-depth plan that takes into account different asset classes, risk tolerance, and prevailing economic conditions. A good long-term plan must include regular assessment and adjustment of your investing approach.

This blog post is only for educational purposes. Consult with a financial advisor to develop a customized strategy based on your financial situation, risk tolerance, and long-term goals

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.