The quest to optimize tax liabilities is an ever-present challenge for individuals in India. While many avenues exist, the strategic utilization of home loans often remains underappreciated.

In this article, we will unravel the nuances of how home loans not only pave the way for homeownership dreams but also wield the potential to significantly reduce tax burdens in the fiscal year.

Home Loans Tax Benefits

1. Interest Deduction under Section 24(b)

One of the pivotal advantages of acquiring a home loan is the deduction available on the interest paid. According to Section 24(b) of the Income Tax Act, homeowners can claim deductions on the interest component of their home loan.

The cap for this deduction is a substantial ₹2 lakhs for self-occupied properties, empowering individuals to make noteworthy savings on their taxable income.

2. Principal Repayment under Section 80C

Section 80C opens another gateway for tax savings through home loans. The principal repayment of the home loan qualifies for deductions under this section, with a maximum limit of ₹1.5 lakhs.

By strategically structuring the loan repayment, individuals can optimize their tax savings while simultaneously building equity in their property.

Lets understand Clearly –

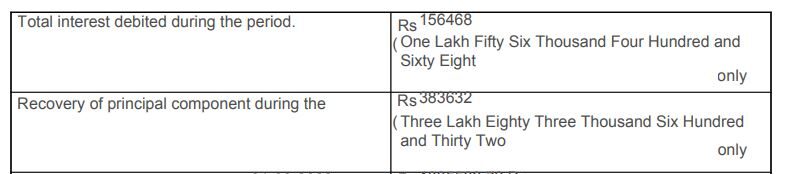

The Above image is a Home Loan Interest Certificate, where the total interest deducted, Repayment of Principal is shown for the fiscal year.

So, Under Section 24(b), you can claim a full deduction of ₹156468, as the limit is ₹2 Lakhs.

Also, Section 80C allows for deductions on the principal amount repaid, with a maximum limit of ₹1.5 lakhs. There are many more Investments eligible for deductions under Section 80C.

Also Read : Eligible Investments under Section 80C

Leveraging Home Loans for Maximum Tax Efficiency

1. Joint Home Loan Applications

For couples contemplating a home purchase, opting for a joint home loan can unlock additional tax benefits. Both co-applicants can individually claim deductions on the interest and principal amounts, effectively doubling the tax savings. This approach proves particularly advantageous for couples with diverse income levels.

2. Home Loan for Renovations

The benefits of home loans extend beyond the initial purchase. Utilizing a home loan for renovations or repairs can provide added tax advantages. The interest paid on a loan taken for home improvement is eligible for deduction under Section 24(b), offering homeowners an incentive to invest in the maintenance and enhancement of their properties.

The Implications for Homebuyers

1. Flexible Repayment Structures

Financial institutions are offering more flexible home loan repayment structures. Opting for longer tenures can result in lower EMIs, rendering homeownership more affordable. Simultaneously, this extended repayment period allows individuals to maximize their tax benefits over a prolonged duration.

2. Government Initiatives

Remaining abreast of government initiatives is paramount for those seeking to optimize their tax positions. Various governmental schemes and incentives aim to encourage home ownership. Staying informed about these programs can lead to additional tax benefits for eligible homeowners.

Upshot

In conclusion, home loans transcend mere avenues to fulfill the dream of owning a home; they are potent tools for tax optimization. Through a nuanced understanding and strategic leveraging of the Income Tax Act’s various sections, individuals can significantly reduce their tax loads while simultaneously investing in real estate. As we navigate the intricate landscape of tax planning, integrating home loans into the financial strategy emerges as a prudent and rewarding choice.