Mutual funds have emerged as one of the most popular investment vehicles in India. They provide a simple yet effective way to grow your wealth, offering professional management and diversification. If you’re curious about how mutual funds work in India and why they are a preferred choice for millions of investors, this comprehensive guide will walk you through every aspect.

What is a Mutual Fund?

A mutual fund is an investment vehicle where money from multiple investors is pooled together and managed by professional fund managers. The fund invests this money in various asset classes like equities, bonds, money market instruments, or a mix of these, depending on the type of mutual fund.

The returns generated by the fund are distributed among the investors based on the number of units they hold, after deducting expenses. Mutual funds operate on the principle of diversification, reducing risk while aiming for optimal returns.

How Mutual Funds Work in India

- Pooling of Money:

When you invest in a mutual fund, your money is pooled with that of other investors. This pooled fund is used to buy a diversified portfolio of securities. - Fund Management:

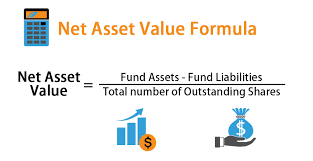

A professional fund manager is responsible for making investment decisions. They analyze market trends, monitor performance, and ensure the fund’s objectives are met. - NAV (Net Asset Value):

The value of your investment in a mutual fund is determined by its NAV. It is calculated as:

- Returns:

The fund generates returns through dividends, interest, and capital gains. These returns can either be reinvested in the fund or distributed to investors. - Regulation:

In India, mutual funds are regulated by the Securities and Exchange Board of India (SEBI). SEBI ensures transparency, investor protection, and adherence to guidelines.

Types of Mutual Funds in India

- Based on Asset Class:

- Equity Funds: Invest primarily in stocks; ideal for long-term wealth creation.

- Debt Funds: Focus on fixed-income securities like bonds; suitable for conservative investors.

- Hybrid Funds: A mix of equity and debt instruments; balances risk and returns.

- Money Market Funds: Invest in short-term debt instruments; ideal for parking surplus cash.

- Based on Structure:

- Open-Ended Funds: Allow buying and selling at any time.

- Close-Ended Funds: Have a fixed tenure; traded on stock exchanges.

- Based on Investment Goals:

- Growth Funds: Aim for capital appreciation over time.

- Income Funds: Focus on regular income through dividends and interest.

- Tax-Saving Funds (ELSS): Provide tax benefits under Section 80C of the Income Tax Act.

Benefits of Investing in Mutual Funds

- Diversification:

Mutual funds spread your investment across various sectors and asset classes, reducing risk. - Professional Management:

Fund managers bring expertise and knowledge to maximize returns. - Affordability:

You can start investing with as little as ₹500 through Systematic Investment Plans (SIPs). - Liquidity:

Most mutual funds allow you to redeem your units anytime. - Transparency:

Regular updates, fact sheets, and performance reports keep you informed. - Tax Efficiency:

ELSS funds offer tax benefits, while long-term capital gains are taxed at favorable rates.

Taxation of Mutual Funds in India

- Equity Funds:

- Short-term Capital Gains (STCG): Taxed at 15% if held for less than 12 months.

- Long-term Capital Gains (LTCG): Gains over ₹1 lakh are taxed at 10%.

- Debt Funds:

- Short-term Capital Gains: Taxed as per your income slab if held for less than 3 years.

- Long-term Capital Gains: Taxed at 20% with indexation benefits.

- Dividends:

Dividends are taxed as per the investor’s income slab, as the Dividend Distribution Tax (DDT) was abolished in 2020.

How to Invest in Mutual Funds

- Set Your Goals:

Define your investment objectives, risk appetite, and time horizon. - Choose the Right Fund:

Select a fund that aligns with your financial goals. Use tools like mutual fund ratings and past performance data for guidance. - Complete KYC:

Complete your Know Your Customer (KYC) process by submitting your PAN, Aadhaar, and other required documents. - Decide the Investment Mode:

- Lump-Sum: Invest a large amount at once.

- SIP: Invest a fixed amount regularly to average out market fluctuations.

- Monitor Your Investment:

Regularly track the performance of your mutual fund and make adjustments if necessary.

Tips for Investing in Mutual Funds

- Understand the Risk:

Every mutual fund carries some level of risk. Higher returns often mean higher risk. - Don’t Chase Past Returns:

Past performance is not indicative of future results. Focus on consistency. - Stay Invested for the Long Term:

Mutual funds work best when held over the long term due to the power of compounding. - Diversify:

Don’t put all your money into one fund. Diversify across asset classes and sectors. - Consult a Financial Advisor:

If you’re unsure, seek professional advice to make informed decisions.

Common Myths About Mutual Funds

- Myth: Mutual funds are only for experts.

Reality: They are designed for everyone, even first-time investors. - Myth: You need a lot of money to invest.

Reality: You can start with as little as ₹500 through SIPs. - Myth: Mutual funds always invest in stocks.

Reality: Mutual funds invest in a variety of asset classes, including bonds and money market instruments.

How to Choose the Right Mutual Fund

- Understand Fund Objectives:

Read the fund’s investment objective and strategy to see if it aligns with your goals. - Check the Expense Ratio:

A lower expense ratio means more of your money is working for you. - Look at the Track Record:

Evaluate the fund’s historical performance over 3–5 years. - Analyze Fund Manager’s Expertise:

The fund manager’s experience and track record can impact the fund’s performance. - Assess Risk Levels:

Match the fund’s risk level with your risk tolerance.

Popular Mutual Fund Categories in India (2025)

- Large-Cap Funds:

Invest in well-established, financially stable companies. - Mid-Cap and Small-Cap Funds:

Offer higher growth potential but come with higher risk. - Index Funds:

Passively track an index like Nifty 50 or Sensex, with lower expense ratios. - Sectoral/Thematic Funds:

Focus on specific sectors like IT, pharma, or infrastructure. - International Funds:

Provide exposure to global markets and foreign companies.

Why Should You Consider Mutual Funds in 2025?

The Indian mutual fund industry has grown significantly in recent years, with increasing awareness and participation among retail investors. With innovations like digital platforms, robo-advisors, and paperless transactions, investing in mutual funds has never been easier.

Additionally, the rising economic growth and a robust regulatory framework make mutual funds a reliable and profitable investment avenue for 2025 and beyond.

Upshot

Mutual funds are an excellent choice for investors looking to grow their wealth while minimizing risk through diversification. By understanding how mutual funds work in India, you can make informed investment decisions that align with your financial goals. Whether you’re a seasoned investor or just starting, mutual funds offer a world of opportunities to achieve financial success.

Start small, stay consistent, and watch your wealth grow over time with mutual funds in India!

Also Read : Which is better Stock Market or Mutual Funds ?

Disclaimer: This blog is for informational purposes only and not financial advice. Please consult a financial advisor and read scheme documents before investing. Mutual fund investments are subject to market risks.