Do you know which bank account is linked to your income tax refund? If not, and you need to update it, don’t worry—we’ve got you covered. This guide explains how to check and change your bank account for income tax refunds online, ensuring that your refund reaches the right account without any hassle.

Why Update Your Bank Account for Income Tax Refunds?

After filing your income tax return, you may be eligible for a refund. However, if the bank account linked to your refund is no longer active or accessible, it’s crucial to update it. Let’s first learn how to check the bank account associated with your income tax refund.

How to Check the Bank Account Linked to Your Income Tax Refund

- Login to the Income Tax Portal:

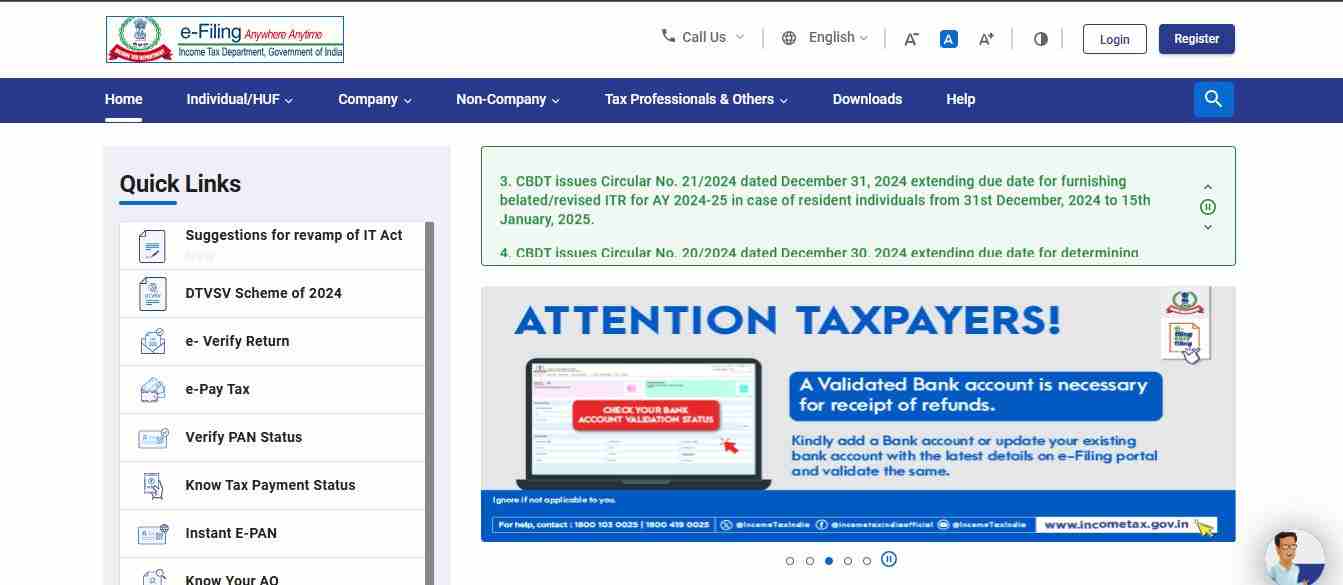

- Visit the income tax e-filing portal.

- Enter your credentials and log in.

- Navigate to ‘My Profile’:

- Once logged in, click on the ‘My Profile’ tab.

- Select ‘My Bank Accounts’ on the right side of the screen.

- View Linked Bank Accounts:

You’ll see three sections under the ‘My Bank Accounts’ tab:- Added Bank Accounts: Displays all the accounts linked for refunds.

- Failed Bank Accounts: Shows accounts where pre-validation failed.

- Removed Bank Accounts: Lists accounts you’ve deleted from the portal.

This is where you can check which account is currently linked to your income tax refund.

Also Read : Income Tax Returns in Brief

Steps to Change Bank Account for Income Tax Refund Online

If you need to update your bank account, follow these steps:

1. Login to the Portal

Log in to the e-filing portal using your credentials and go to ‘My Profile’ as shown earlier.

2. Add a New Bank Account

- Click on the ‘Add Bank Account’ button.

- Enter the following details:

- Bank Account Number

- Account Type (Savings or Current)

- Holder Type (Single or Joint)

- IFSC Code

Once you enter the IFSC code, the Bank Name and Branch Name will auto-fill.

3. Validate Your Bank Account

- Click Validate to verify the details.

- A success message will appear upon validation. You’ll also receive a notification via SMS and email.

4. Nominate the New Bank Account for Refund

- Go back to the ‘My Bank Accounts’ section.

- Find the newly added account and toggle the ‘Nominate for Refund’ switch to enable it.

5. Confirm Your Selection

- Click Continue to confirm.

- Once confirmed, the toggle will move to the right, indicating the account is now nominated for refunds.

Important Notes:

- To validate your bank account, you may need to log in through your Net Banking.

- Ensure your mobile number and email ID linked with the bank account match the details on the e-filing portal.

- You can nominate only one bank account for refunds at a time, but you can update this anytime.

Upshot

Updating your bank account for income tax refunds is a straightforward process. With just a few clicks, you can ensure that your refunds are credited to the correct account. Whether you need to check existing accounts or nominate a new one, the income tax portal provides all the tools you need to manage this efficiently.

By following this guide, you can avoid delays in receiving your refunds and stay on top of your financial matters.

Also Read : How to Check Your Income Tax Refund Status Online in Seconds