Trading can be a thrilling way to grow your wealth, but it also comes with its fair share of risks. To truly succeed, traders need to strike a balance between risk and return in trading. This guide walks you through essential strategies, metrics, and tools that will help you navigate this balance and make smarter, more informed trading decisions.

What Are Risk and Return in Trading?

At its core, risk in trading refers to the potential for financial loss, while return represents the profit earned from your investments. These two factors are inherently linked—higher potential returns usually come with higher risks.

To become a successful trader, understanding this relationship is critical. Whether you’re trading stocks, forex, or cryptocurrencies, mastering risk and return in trading lays the foundation for long-term growth.

Why Is Risk and Return Analysis Important?

Analyzing risk and return in trading allows you to:

- Optimize Your Portfolio: Diversify your investments to minimize exposure to a single asset.

- Make Informed Decisions: Identify opportunities with the best reward-to-risk ratio.

- Protect Your Capital: Avoid catastrophic losses by managing your risks wisely.

When you analyze risk and return in trading, you’re not just looking at numbers—you’re building a strategy for financial sustainability.

Key Metrics to Measure Risk and Return in Trading

To make informed trading decisions, you need to rely on proven metrics. Here are the key ones:

1. Standardx Deviation

This metric measures how much an asset’s price fluctuates. A higher standard deviation indicates greater volatility, which means higher risk but also the potential for higher returns.

Example: A tech stock may have a high standard deviation, offering lucrative returns but significant price swings.

2. Beta Coefficient

Beta measures an asset’s sensitivity to overall market movements.

- Beta = 1: Moves in sync with the market.

- Beta > 1: More volatile than the market.

- Beta < 1: Less volatile, lower risk.

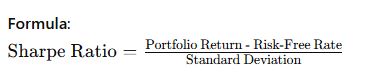

3. Sharpe Ratio

This measures the return on an investment after adjusting for risk. A higher Sharpe ratio indicates better risk-adjusted performance.

Portfolio Return = 12%

Risk-Free Rate = 3%

Standard Deviation = 8%

Using the formula:

Sharpe Ratio = (12% – 3%) / 8% = 1.125

This result indicates that for every unit of risk taken, the portfolio yields 1.125 units of excess return.

4. Value at Risk (VaR)

VaR calculates the potential loss of an investment over a specified time period under normal market conditions.

Example: A daily VaR of $10,000 means there’s a 5% chance of losing more than this amount in a single day.

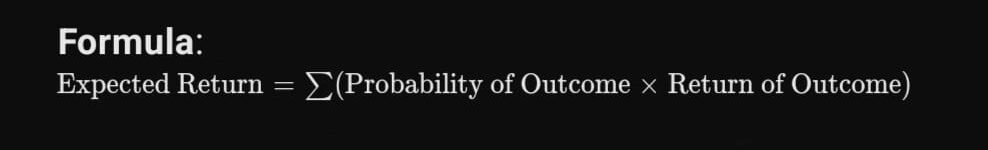

5. Expected Return

This metric estimates the average return based on possible outcomes and their probabilities.

Suppose you’re trading a stock and estimate the following possible outcomes:

- 60% chance the stock will gain 10%.

- 40% chance the stock will lose 5%.

Applying the formula:

Expected Return=(0.6×10)+(0.4×−5)

Expected Return = 6 – 2 = 4% , The expected return from this trade is 4%. This means, based on the probabilities of the outcomes, you can expect an average return of 4% from this trade.

How to Analyze Risk and Return in Trading

1. Determine Your Risk Tolerance

Your risk tolerance depends on factors like financial goals, time horizon, and comfort level with potential losses.

- Low Risk Tolerance: Focus on stable investments like government bonds or large-cap stocks.

- High Risk Tolerance: Explore volatile assets like cryptocurrencies or small-cap stocks.

2. Diversify Your Portfolio

A diversified portfolio spreads risk across different assets, sectors, or geographies.

Example: Combine equities, commodities, and ETFs to minimize exposure to any single market event.

3. Use Fundamental and Technical Analysis

Fundamental analysis evaluates an asset’s value based on financial data and economic trends, while technical analysis focuses on price patterns and market behavior. Combining these methods helps you assess both risks and returns more accurately.

4. Set Stop-Loss and Take-Profit Levels

Stop-loss orders limit your losses by automatically selling an asset at a predefined price, while take-profit orders lock in gains.

Example: If you buy a stock at $50, set a stop-loss at $45 to minimize losses and a take-profit at $60 to secure gains.

5. Monitor Asset Correlation

Understanding how different assets in your portfolio interact can reduce risk.

Example: Stocks and gold often have a negative correlation. Adding gold to your portfolio can act as a hedge during market downturns.

Common Mistakes in Risk and Return Analysis

1. Letting Emotions Influence Decisions

Fear and greed can cloud judgment. Avoid emotional trading by sticking to a well-defined plan.

2. Ignoring Hidden Costs

Brokerage fees and taxes can significantly reduce returns. Always factor in these costs when evaluating potential trades.

3. Neglecting Regular Reviews

Markets evolve, and so should your strategy. Periodically review your portfolio to ensure it aligns with your current goals and risk appetite.

Proven Risk Management Strategies

1. Position Sizing

Allocate a specific portion of your capital to each trade based on your risk tolerance.

Example: The 2% rule ensures that no single trade risks more than 2% of your total capital.

2. Hedging

Offset potential losses by taking opposing positions using derivatives like options or futures.

3. Leverage Control

Leverage amplifies both gains and losses. Use it cautiously, especially in volatile markets, and maintain sufficient margin in your account.

Trading Styles and Their Risk-Return Balance

1. Day Trading

High-risk, high-reward style focusing on short-term price movements. Requires quick decision-making and robust strategies.

2. Swing Trading

Medium-risk approach targeting short- to medium-term trends. Balances risk and return effectively.

3. Long-Term Investing

Low-risk style focused on steady growth over time. Ideal for risk-averse traders.

Upshot

Mastering risk and return in trading is the cornerstone of sustainable success. By leveraging essential metrics, diversifying your portfolio, and employing proven risk management strategies, you can minimize potential losses while maximizing gains.

Trading isn’t just about chasing profits—it’s about protecting your capital and ensuring long-term growth. With a balanced approach, you can navigate the markets confidently and build a solid financial future.

Start implementing these strategies today to take control of your trading journey and achieve consistent success.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Trading involves significant risk, and past performance is not indicative of future results. Always conduct your own research or consult with a qualified financial advisor before making any investment or trading decisions. The author and the website are not responsible for any losses or damages incurred as a result of your trading activities.